Shale rigs idle, layoffs rise as $60 oil tests resilience of Permian [View all]

Source: msn/Reuters

12h

MIDLAND, TEXAS, Nov 21 (Reuters) - At the heart of the U.S. shale industry in Texas, oil production is climbing. But you wouldn't know that if you talked to Mark Waters, who owns a store that sells tools and safety equipment to oil firms.

His small business, Tie Specialties, in Odessa, Texas, saw a 25% drop in oilfield sales over the last four to six months. Shelves are stacked with hand tools like wrenches, augers for digging holes, shovels, and other power tools. Peg boards show off hard hats, gloves, and various colored overalls. "This is my sixth boom-bust. So I've been around it. I'd call it a slowdown, but everybody that I've talked to says the future is not very bright for the next couple of years," said Waters, 65.

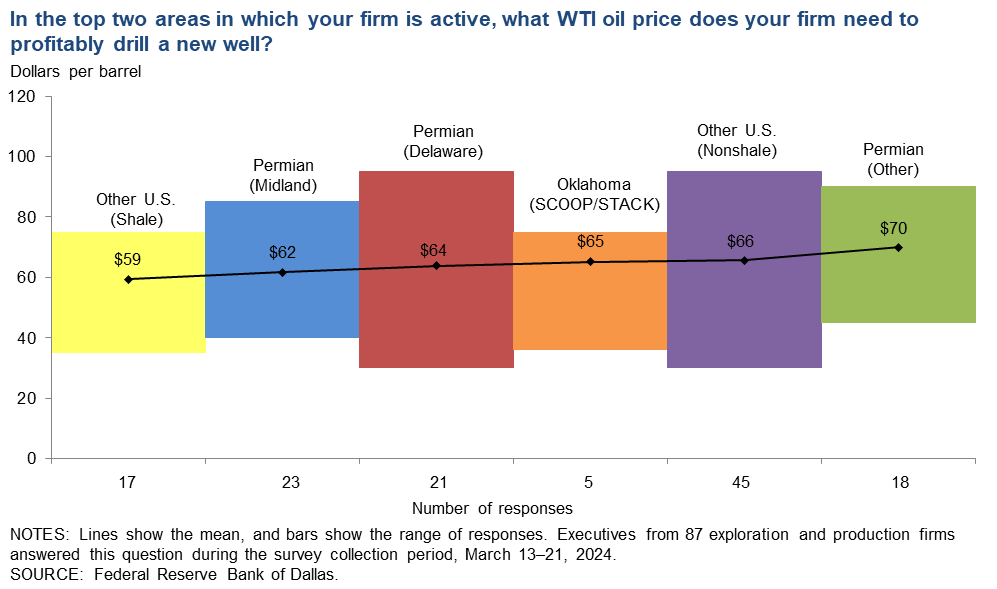

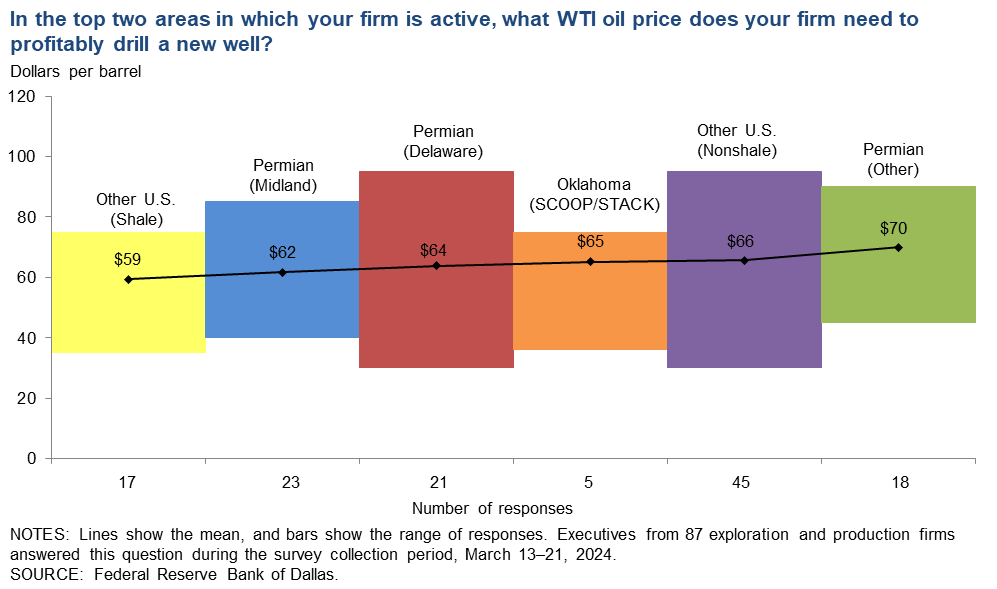

U.S. oil output has yet to register the full impact of the downturn. Waters and others who make their living around the oilfield are finding it more difficult to turn a profit as crude hovers around $60 a barrel, signaling bigger economic woes are on the way, Reuters interviews with 10 producers, service companies and residents around the Permian Basin show.

The largest U.S. oilfield has weathered previous downturns, but President Donald Trump's policies have added to the slide in per-barrel profitability of U.S. producers, already stifled by rising output from producer group Organization of the Petroleum Exporting Countries and its allies, as well as the biggest wave of consolidation in a generation.

Read more: https://www.msn.com/en-ca/money/topstories/shale-rigs-idle-layoffs-rise-as-60-oil-tests-resilience-of-permian/ar-AA1QT3LI

As some may have seen me post - the current "glut" (with more to come from OPEC/OPEC+) is killing the shale folks because the current price per/bbl is right around the average "breakeven" if they had to drill any new wells.