No, AI is Not A Bubble

Economics are often like an Escher drawing -- individual parts make sense but when you put it all together it is absurd. Yet, like the ever-ascending staircases, indexes continue to rise. As the saying goes 'Markets can remain irrational longer than you can remain solvent.' IOW don't bet against long term growth.

2007/2008 was a bubble because banks took the position that the value of real estate could not go down. A Ponzi scheme has no underlying business. A bubble is prices decoupled from underlying valuations. AI is neither of those.

NVDA via their CUDA API has been the fundamental layer on which AI was built for 20 years. Now there is no getting away from it.

TSM and AMAT feed directly into Nvidia's monopoly. They have a position from which they cannot be dislodged.

Downstream from these three and growing rapidly is the introduction of nuclear power which cannot be a bubble because electric rates are soaring so even if AI went away tomorrow, nuclear power (FRMI, IMSR) would remain profitable.

NVDA has a market cap of $5 trillion dollars but is still only trading at 59 P/E. Crazy but true. Earnings are $84 billion and growing at 120% YoY meaning that the price of NVDA could double in the next 12-month and still wind up lower than 59 P/E.

The narrative about "AI is Bubble" is helping NVDA consolidate its hold on the future. By introducing and amplifying skepticism, competitors are disadvantage at the very time that the AI ship is leaving the dock. Retail investors are being encouraged not to bid up prices while hedgies and financials load up.

https://www.marketwatch.com/investing/stock/nvda/financials?mod=mw_quote_tab

Fiendish Thingy

(22,657 posts)Likely espoused by a pump and dump strategist.

Go watch “The Big Short”.

GreatGazoo

(4,531 posts)I like your skepticism but it is misplaced because while the big boys are telling you not to buy because "it's a bubble" they are buying with both hands.

'The Big Short' -- is about a bank-driven real estate bubble. If we make an analogy to now then the banks and brokers who were yelling "real estate can't go down" are the same ones yelling "AI is bubble".

ETA: Did I miss a personal smear in your post? You are saying that about me?

Fiendish Thingy

(22,657 posts)The pump and dump comment was about the pros, not you.

![]()

GreatGazoo

(4,531 posts)All good.

This was one of many analyses about how AI plays out and whether the bubble thing is right or wrong:

https://machine-learning-made-simple.medium.com/why-jensen-huang-loves-the-ai-bubble-stories-a57730f21abb

walkingman

(10,612 posts)GreatGazoo

(4,531 posts)I embrace the gamblers' motto "Never place a bet you don't understand" so I do my best to understand the business of AI and the sea change that is under way. I like that the author put together as many pieces as they could and looked into the loop of investment that we have all heard about because that is/was concerning.

Bernardo de La Paz

(60,320 posts)GreatGazoo

(4,531 posts)I value your perspective. ![]()

Bernardo de La Paz

(60,320 posts)Bernardo de La Paz

(60,320 posts)It is not a bubble, because it is the real deal, a BFD, just like the internet was and is the real deal. I've been saying you ain't seen nothin' yet, and I stand by that. Productivity gains are undeniable where there are gains (not all AI in business has gains). The AI of 2040 and 2050 will blow your socks off, and a robot will pick them up and hand them back to you.

It IS a bubble because the market and the companies are getting ahead of their skis. AI is being over-promised just like the internet was over-promised in 2000. Bubbles form when people think markets have changed and will not decline significantly going forward. General intelligence AI is coming, but not in this iteration.

The internet required a few innovations (fibre, broadband) and lots of build out to deliver in the 2010s what was promised in 2000. So it is with AI. Nvidia is likely to survive just like Intel of 2000 survives more or less in 2025, and IBM of 1975 survives in 2025.

I think anyone who believes the market won't decline at least 50% from the coming top is in for a shock. In 2000 the NASDAQ topped over 5,000 and fell about 80% to around 1,000 by about 30 months later. It took 15 years, fifteen years, to get back to 5,000. But it has increased from there. In the last 3 years it has doubled and is now about 24,000.

How does a bubble that is not a bubble burst? When the real world intervenes. Do not lose sight of macro economics. Bull markets longer than three years (coming up) are the exception, not the rule (a bit less than two is average). Projections of unending growth are only projections.

There will be a recession. We do not know when. The seeds are already growing. A) Supply chains are disrupted (tariff taxes). B) Labour supply is disrupted (deportation fears). C) Infation is stubborn, though not terrible. D) US national debt is growing out of control due to billionaire tax cuts and none for consumers. E) Consumer wages have not kept up with cost of living, cost of housing, or productivity. F) The stock market is increasingly frothy with over-valued IPOs. G) AI implementation in business is not easy or smooth (85% of pilot projects get nixed before roll out). H) Social disruption may be coming, in the form of militarization against citizens and election disruption. I) There are other risks that don't come to mind immediately.

The situation is that for the market to continue rising steadily the way it has, everything has to go almost perfectly. The stock market over-valuation by the Shiller (Nobel laureate) CAPE index https://www.multpl.com/shiller-pe , at 40.9, is above 1929 levels (31.5) and almost as high as dot-com bubble got to (44.2).

Don't bet against AI. Bet against the bubble, conserve cash, and buy the bottom because AI is the real deal. The timing and details are up to you because I do not have a crystal ball. But history rhymes even though it does not repeat.

GreatGazoo

(4,531 posts)but picking winners right now is fish in a barrel. I can't make money shorting or buying puts. I more of a stop loss guy, eg ready to be wrong and bail out before the real damage starts. Stop loss saved me in late February. Bought it all back in late April. I recommend stop loss for anyone who is not concerned about a tax hit from selling.

"Buy at the bottom" is impossible because no one can call the bottom. After a retest is generally good. V-shapes seem to be the new mode. March 2020 changed everything. Confirmed that the Fed would rather act early than let the markets fall. They printed a whole lot of money and, for better or worse, they will do it again. New Fed chief in April of 2026 is expected to be dove-ish in the extreme, will juice the markets and the money supply, further eroding the USD. Cash is down 11% YTD vs. QQQ up 22%. We think of cash as safe but further erosion seems guaranteed.

AI is chips, software, data centers and energy. All of which have value outside of AI. This is different from the dynamics of the dot com bubble where pets.com and others had no other revenue or value before or outside of internet sales. The internet, as most people knew it (AOL via dial up), was only 6 years old at that point. People, including experienced and institutional investors, did not understand it very well but they FOMO'd into that bubble. The infamous AOL + Time Warner merger in January 2000 felt four years too late. It echoed the desperation of AOL buying Netscape in November of 1998. I'm not seeing that dynamic now -- not seeing legacy companies buying emerging competitors to stave off doom... Except for Adobe trying to buy Figma (FIG) in 2022.

Bernardo de La Paz

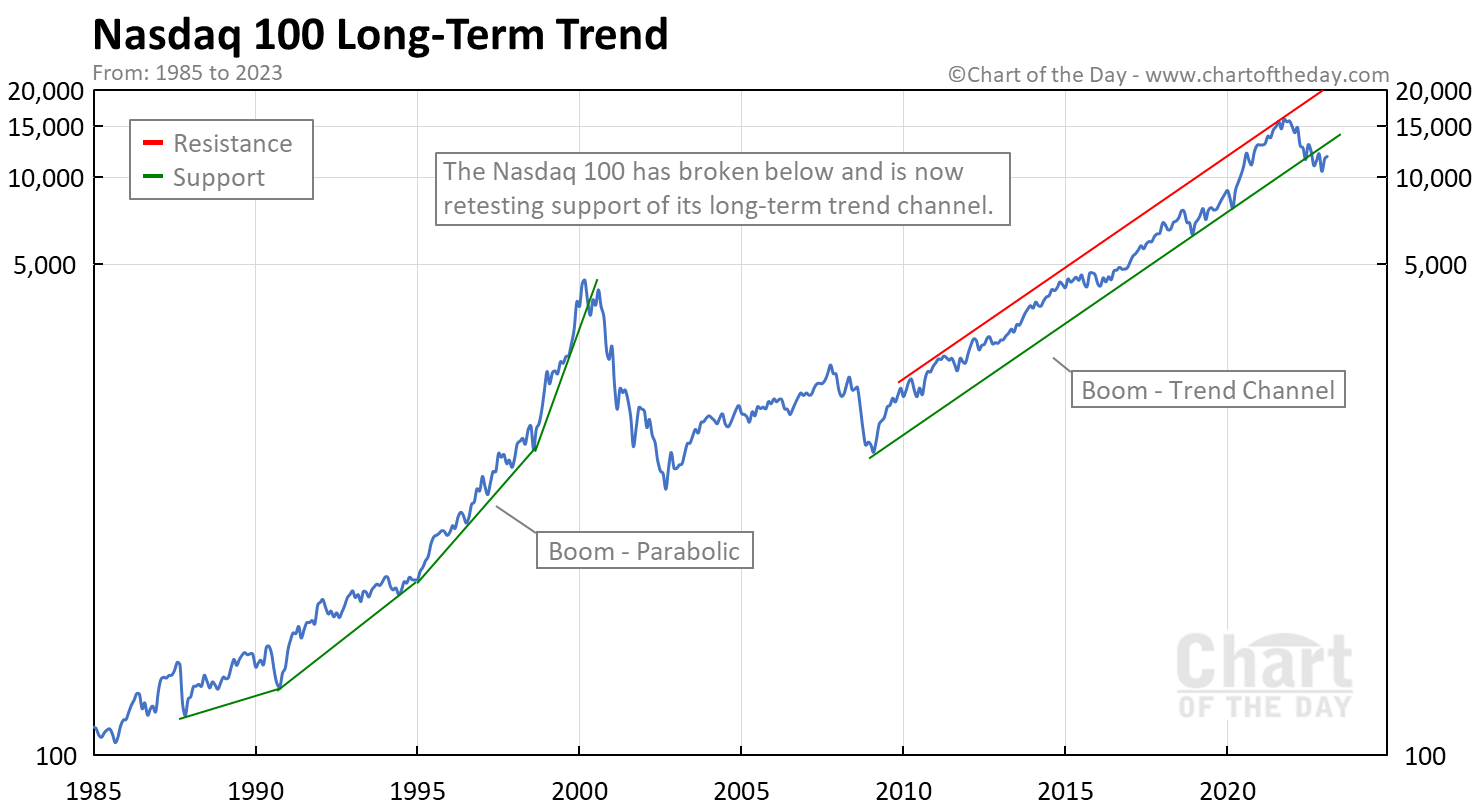

(60,320 posts)Here is a great chart, but it doesn't display properly on my browser. I have to right-click it and choose Open in New Tab.

It shows the NASDAQ in logarithmic (log) volume (the only realistic way to look at stocks and indices). You can see the parabolic rise up to 2000, which is one difference between this bubble and the dot-com bubble, and a reason why I think this bubble is less severe than that one. You can also see the 15 or 16 years it took to get back the value. The trend channel it illustrates is very interesting.

Nasdaq has since recovered and reached new highs. One could probably draw a new trend channel, a bit shallower.

I found the site: https://www.chartoftheday.com/nasdaq-100-long-term-trend

progree

(12,860 posts)Error 1011 Ray ID: 998fc4ec09184ca8 • 2025-11-03 23:49:37 UTC

Access denied

What happened?

The owner of this website (www.chartoftheday.com) does not allow hotlinking to that resource (/wp-content/uploads/charts/nasdaq-100-long-term-trend.png).

Please see https://developers.cloudflare.com/support/troubleshooting/http-status-codes/cloudflare-1xxx-errors/error-1011/ for more details.

Bernardo de La Paz

(60,320 posts)cliffside

(1,645 posts)for the upper line, added a middle dashed line. The second chart is just a closer view.

When I started looking at historical charts in late 1999 it was an eye opener, especially if one is close to retirement, or the annual gains are too far from the norm.

https://www.tradingview.com/x/0SPtTBd4/

https://www.tradingview.com/x/45aJilK6/

Historical charts, I'm going to post this link in a new thread if anyone is interested.

https://stockcharts.com/freecharts/historical/marketindexes.html

Happy Hoosier

(9,472 posts)AI isn't going away, for sure. But it is ABSOLUITELY over-capitalized at the minute, and the funding/investment is circular.

I think a correction is inevitible. How big? I don't know. No one does. But I'm not trying to second-guess the market. I'll just ride the lightning for the time being.

GreatGazoo

(4,531 posts)The circular thing is called vertical integration when other industries do it.

What I can't ignore is the US gov treating AI like an arms race. When they make direct investments in publicly traded companies the game is being rigged.

Happy Hoosier

(9,472 posts)I can stop loss my brokerage, of course. Even then, though, I have just enough runway until retirement that I'm not sweating this TOO much. I expect it to happen at some point, and it'll recover.