Crypto Bank Machine Operators Swindle Seniors

https://prospect.org/economy/2025-09-11-crypto-bank-machine-operators-swindle-seniors/

https://prospect.org/economy/2025-09-11-crypto-bank-machine-operators-swindle-seniors/

With

the golden age of scams in full swing, it is perhaps unsurprising that one of the largest Bitcoin automated teller machine (BTM) operators in the country is being sued for alleged complicity in pervasive international fraud—and it’s not the first time. On Monday, Washington, D.C., Attorney General Brian Schwalb filed a lawsuit against Athena Bitcoin following a monthslong investigation into the company’s business practices. According to the

lawsuit, Athena allegedly facilitated financial fraud, illegally profited from hidden fees, and refused to refund victims who were “scammed out of life-altering amounts of cash.” In total, 93 percent of all Athena BTM deposits in Washington, D.C., were linked to scams, the lawsuit estimates, and nearly half of the deposits “were flagged to Athena as the product of fraud.”

“Athena’s bitcoin machines have become a tool for criminals intent on exploiting elderly and vulnerable District residents,” Schwalb

said in a statement. “Athena knows that its machines are being used primarily by scammers yet chooses to look the other way so that it can continue to pocket sizable hidden transaction fees.” Through a spokesperson, Athena said it “strongly disagrees with the allegations” and “will defend itself in court.” The company also claimed it employs aggressive safety protocols, but the D.C. lawsuit alleges that these self-imposed safeguards are not only ineffective but harmful, arguing that “rapid prompts, wordy warnings, and long, complicated legal disclaimers … exacerbate the confusion and pressure that scammers create for their victims.” Athena did not respond to additional requests for comment.

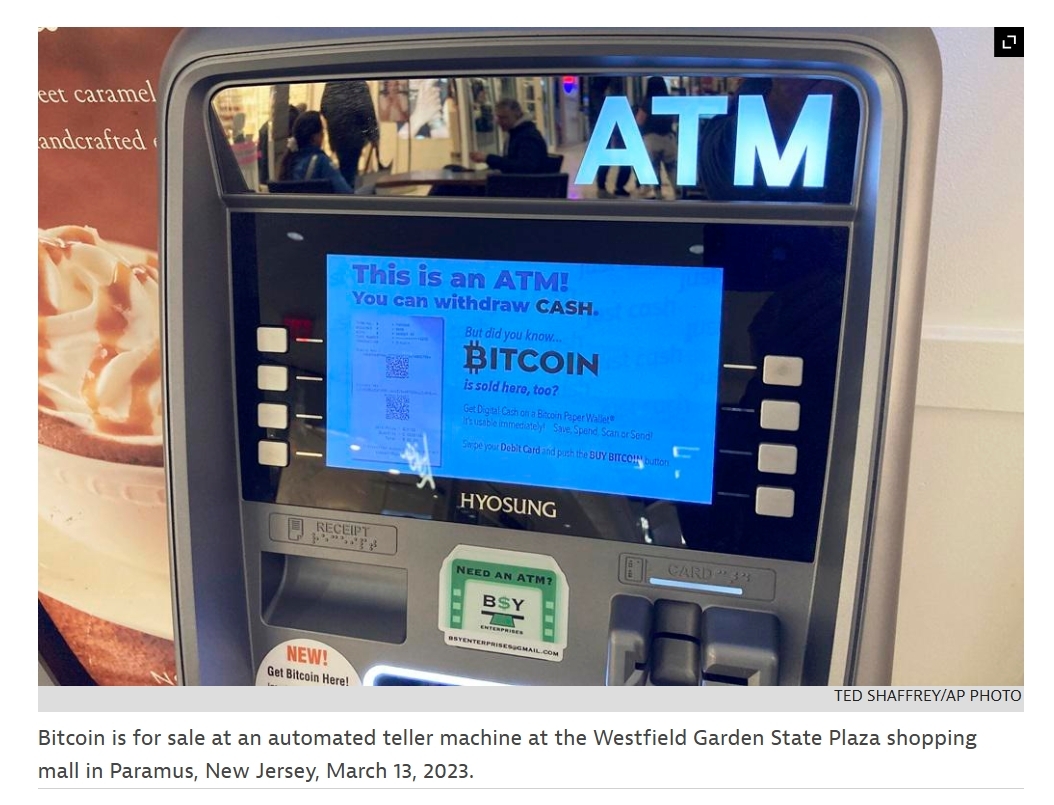

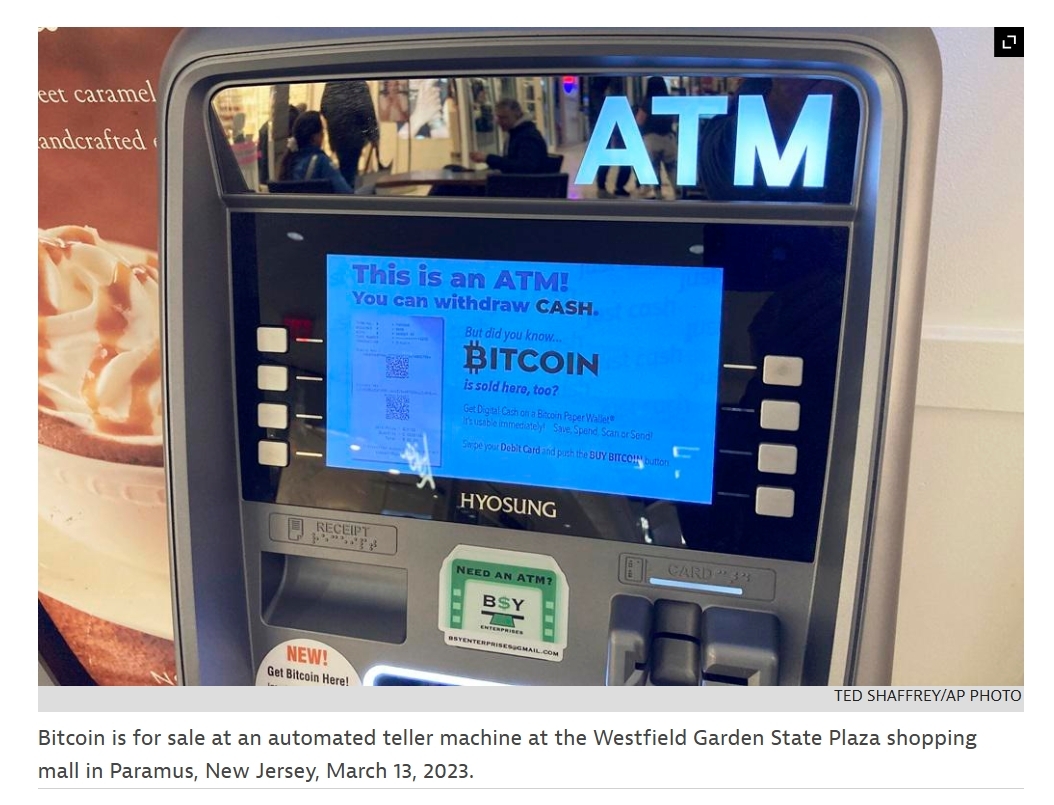

BTMS CONVERT CASH INTO CRYPTO, which can then be transferred to a digital wallet. The number of crypto bank machines nationwide

has skyrocketed in recent years, and the U.S. has continued to dominate the global market, hosting

over 80 percent of the world’s BTMs at the end of 2024. Critics and some regulators charge that these machines, which have established a growing presence in convenience stores, gas stations, and supermarkets, are becoming a primary conduit for impersonation scams that fleece

retirees and

residents of low-income neighborhoods (where many of these kiosks are clustered) out of their hard-earned savings.

According to

data from the Federal Trade Commission (FTC), fraud losses involving these kiosks increased nearly tenfold to over $110 million between 2020 and 2023. During the first half of 2024, fraud losses surpassed $65 million, with elderly individuals accounting for 70 percent of that total. In addition, the FTC found that consumers over the age of 60 were “more than three times as likely as younger adults” to report losing money to BTM scams. In November 2024, attorneys with DannLaw filed a class action

lawsuit against Athena in the Superior Court of New Jersey. As part of the lawsuit, the attorneys sued chief executive officer Matias Goldenhörn directly, as well as the owners of convenience stores with Athena-operated BTM kiosks throughout the state. “BTMs are specifically designed to appeal to criminals,” DannLaw founder and former Ohio Attorney General Marc Dann

commented last year. “That’s why I consider them to be the AR-15s of the financial services industry.”

snip