General Discussion

Related: Editorials & Other Articles, Issue Forums, Alliance Forums, Region ForumsMoody's downgrades United States credit rating on increase in government debt

This is not a good thing. Borrowing costs will go up. trump took a great economy and is destroying it

Moody's downgrades United States credit rating on increase in government debt www.cnbc.com/2025/05/16/m...

— Joyce M (@jkmoore.bsky.social) 2025-05-16T20:54:24.275Z

Link to tweet

https://www.cnbc.com/2025/05/16/moodys-downgrades-united-states-credit-rating-on-increase-in-government-debt.html

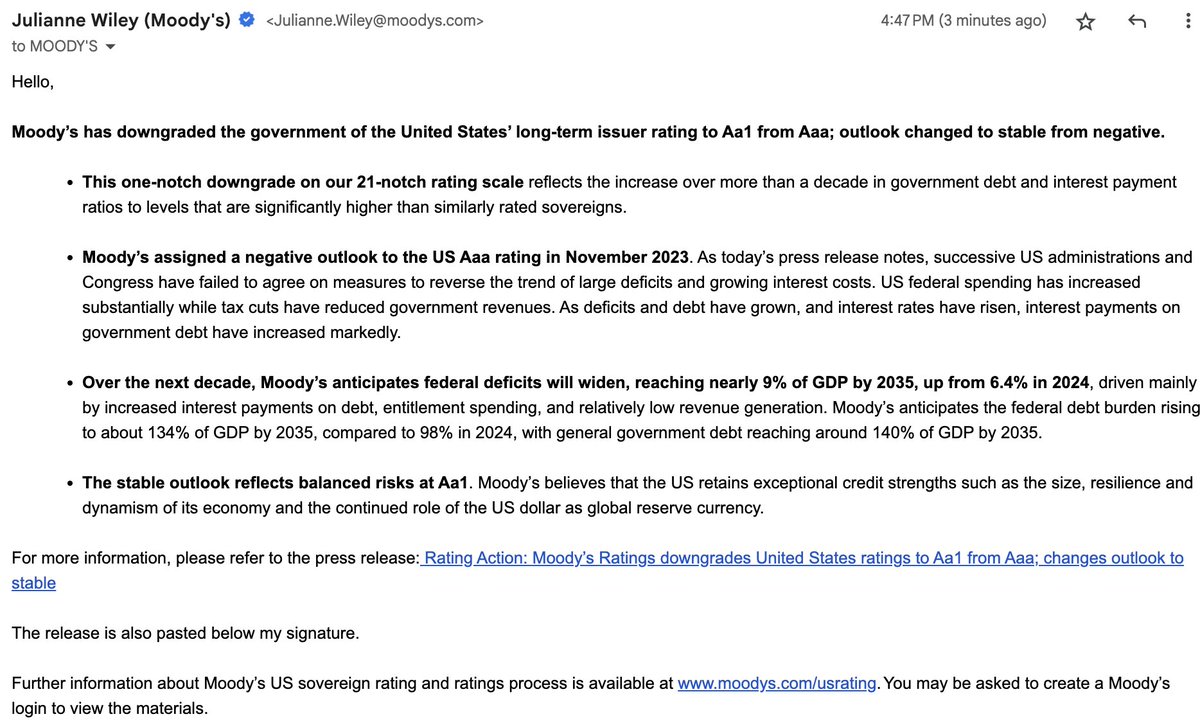

“This one-notch downgrade on our 21-notch rating scale reflects the increase over more than a decade in government debt and interest payment ratios to levels that are significantly higher than similarly rated sovereigns,” the ratings agency said in a statement.

The U.S. is running a massive budget deficit as interest costs for Treasury debt continued to rise due to a combination of higher rates and more debt to finance. The fiscal deficit totaled $1.05 trillion year to date, 13% higher than a year ago. The influx in tariffs helped shave some of the imbalance last month, however.

Moody’s had been a holdout in keeping U.S. sovereign debt at the highest credit rating possible, and brings the 116-year-old agency into line with its rivals. Standard & Poor’s downgraded the U.S. to AA+ from AAA in August 2011, and Fitch Ratings also cut the U.S. rating to AA+ from AAA, in August 2023.

LetMyPeopleVote

(175,036 posts)Link to tweet

That’s right: the only major credit agency that hadn’t downgraded us under Trump just did.

Who else enjoying all this “economic winning” under Trump? 🤷♂️

newdeal2

(4,804 posts)Fox News will explain how it means Trump, and therefore they by extension, are winning.

dutch777

(4,891 posts)Johnny2X2X

(23,693 posts)Remember when this happened under Obama? The media lost their minds for 6 months about it.

WarGamer

(18,256 posts)LetMyPeopleVote

(175,036 posts)WarGamer

(18,256 posts)But the rating has been dropping for many years.

In fact it dropped in 2011, 2022, 2023 and 2024 also with different rating firms.

Makes one think... something is wrong with the system.

https://www.bbc.com/news/articles/c4ge0xk4ld1o

The US has lost its last perfect credit rating, as influential ratings firm Moody's expressed concern over the government's ability to pay back its debt. In lowering the US rating from 'AAA' to 'Aa1', Moody's noted that successive US administrations had failed to reverse ballooning deficits and interest costs.

A triple-A rating signifies a country's highest possible credit reliability, and indicates it is considered to be in very good financial health with a strong capacity to repay its debts.

Moody's warned in 2023 the US triple-A rating was at risk. Fitch Ratings downgraded the US in 2023 and S&P Global Ratings did so in 2011. Moody's held a perfect credit rating for the US since 1917.

David__77

(24,508 posts)LetMyPeopleVote

(175,036 posts)In 2011, the GOP was responsible for a U.S. credit rating downgrade. In 2023, it happened again. And in 2025, Republicans are again to blame.

Why the latest downgrade of the U.S. credit rating is an embarrassment for Republicans - MSNBC

— (@oc88.bsky.social) 2025-05-19T14:00:03.209Z

apple.news/AJEUHJcLzQhO...

Link to tweet

https://www.msnbc.com/rachel-maddow-show/maddowblog/latest-downgrade-us-credit-rating-embarrassment-republicans-rcna207652

Moody’s Ratings cut the United States’ sovereign credit rating down a notch to Aa1 from the Aaa, the highest possible, citing the growing burden of financing the federal government’s budget deficit and the rising cost of rolling over existing debt amid high interest rates.

In terms of the practical economic impact, neither the 2011 nor the 2023 downgrades did meaningful harm, though as NBC News’ report added, the decision from Moody’s might end up lifting the yield that investors demand in order to buy U.S. Treasury debt and could dampen sentiment toward owning U.S. assets. Time will tell.

But in terms of the political impact, Donald Trump’s White House tried to blame Biden for the developments — a go-to move for this administration — despite the fact that deficits exploded during Trump’s first term and were far smaller under Biden.

Even more interesting, however, was the reaction from House Speaker Mike Johnson. The New York Times noted:

In his appearance on ‘Fox News Sunday,’ Speaker Mike Johnson tried to spin Moody’s recent downgrading of U.S. credit worthiness away from House Republicans’ multi-trillion-dollar spending package and recast it as a product of ‘the Biden spending spree.’ He argued that the inferior credit rating was evidence that ‘emphasizes the very need for the legislation we’re talking about.’

.....This need not be complicated. Moody’s downgraded the United States because of the country’s national debt and fiscal future. The GOP’s reconciliation bill, filled with massive tax breaks, would add nearly $3 trillion to projected budget deficits over the next decade. (As for the idea that there was a “Biden spending spree,” now seems like a good time to remind everyone that government spending has gone up, not down, since Donald Trump returned to power.)

In other words, the fiscal problem that led to the downgrade would get worse because of the Republican’s megabill, which is the opposite of the line GOP leaders have brought to the public.

BoRaGard

(7,591 posts)If this is "conservative" then it needs be flushed down the toilet ![]()

GoodRaisin

(10,736 posts)LetMyPeopleVote

(175,036 posts)Interest rates are going up due to the credit downgrade and concerns about increase deficits

Mortgage rates cross back over 7% after U.S. credit downgrade www.cnbc.com/2025/05/19/m... #residential #RealEstate #housing

— DeSota Wilson (@desota.bsky.social) 2025-05-19T20:07:57.125Z

https://www.cnbc.com/2025/05/19/mortgage-rates-us-credit-downgrade.html

Bond yields rose after the late Friday announcement, and mortgage rates loosely follow the yield on the 10-year Treasury.

The average rate on the popular 30-year fixed loan hit 7.04% on Monday, according to Mortgage News Daily. That is the highest level since April 11.

“The average mortgage lender had to account not only for the market movement in Friday’s closing minutes, but also to the additional weakness seen this morning. That makes for a fairly big jump, day-over-day, but it does very little to change the bigger picture,” said Matthew Graham, chief operating officer at Mortgage News Daily.

The April surge in mortgage rates did have a direct effect on the housing market, causing it to pull back right in the heart of the usually busy spring season. Pending sales of existing homes in April, counted by signed contracts, dropped 3.2% compared with April of last year, according to Realtor.com.

Homebuilders also noted a steep drop in demand in April. Homebuilder sentiment is now at the lowest level since the end of 2023, according to the National Association of Home Builders’ monthly index.